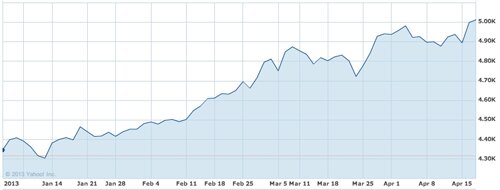

El índice de la bolsa de Jakarta rompe por fin la barrera de los 5.000 puntos

El Jakarta Composite Index (JCI) superó la barrera psicológica de 5.000 puntos por primera vez en la historia el jueves 18 de abril de 2013

The Jakarta Composite Index (JCI) passed the 5,000 psychological barrier for the first time in its history on Thursday as foreign investors continued to pump fresh funds into the market.

While prices for most other Asian exchanges declined, the JCI, the main barometer of the Indonesian Stock Exchange (IDX), closed at 5,012.64 on Thursday, up 0.28 percent from the previous day.

Thursday’s close also brought the year-to-date growth rate for the IDX to 16.12 percent, leaving behind indices in other Southeast Asian markets, such as Thailand’s (9.9 percent) and Singapore’s (4.08 percent).

While more than 6.11 billion shares changed hands during the day, lower than the average daily volume of 6.22 billion, the value of the trading was Rp 6.7 trillion (US$689 million), more than the daily average of Rp 6.27 trillion.

Edwin Sebayang of PT MNC Securities said that the index’s growth had principally been driven by increased foreign funds inflows coupled with economic stimulus packages recently announced by Japan and South Korea.

Edwin said that foreign funds inflows had increased as fund managers turned to emerging markets such as Indonesia for higher returns.

Japan’s plan to boost its economy by injecting $1.4 trillion follows a South Korean proposal for a 17.3 trillion won ($15.3 billion) stimulus announced on Tuesday to revive slowing growth in the country.

The moves follow a third round of quantitative easing by the US last year and a Chinese plan to increase fiscal spending. As much as Rp 409.8 billion in foreign funds were pumped into the Indonesian stocks on Thursday, pushing up the foreign net buy to Rp 18.2 trillion year to date.

Edwin said that total value of foreign net purchases of Indonesian stocks might touch Rp 25 trillion by year end, which would be up 67 percent compared from Rp 15 trillion last year.

“The new psychological barrier will also attract domestic investors to come into the market. Pension funds are converting investments in bonds to stocks and so are institutional asset managers,” Edwin said.

Seaparately, Yudhi Rangkuti, mutual fund sales manager for PT Schroders Investment Management, said that most of the foreign funds invested locally this month came from Japan.

“Money is coming to emerging markets, particularly Indonesia and Philippines. Here, investors are picking various stocks, but mostly shares in the automotive and infrastructure sectors,” Yudhi said.

The index of the Philippine Stock Exchange (PSEi) has increased by 19.09 percent year-to-date.

Asian stocks fell, with the regional benchmark index set for its biggest drop in a month, led by mining companies as commodities slumped on concerns that weaker global economic growth would crimp demand for raw materials, Bloomberg reported on Thursday.

The MSCI Asia Pacific Index slipped 1.1 percent to 135.85 as of 7:19 p.m. in Tokyo, heading for its biggest drop since March 18. All 10 industry groups fell on the gauge, which is set for its third decline in four days after China’s economy expanded less than economists estimated. The International Monetary Fund this week cut its global growth forecast as Europe sinks deeper into recession.

Fuente: thejakartapost / Foto: yahoo / Selección: JLJM